1099-MISC and Annual Statement FAQs

Contents

What is a 1099-MISC and why am I receiving one?

A 1099-MISC is an IRS tax form that reports gross rental income collected on your behalf during the calendar year.

As your property manager, we are required to issue this form because rent was collected through our system in 2025. The amount shown reflects gross rent receipts only. It does not subtract expenses, management fees, or repairs.

Your 1099-MISC should be reviewed alongside your Annual Income Statement and Cash Flow reports, which provide the full financial picture of your property.

If you have questions about how to report this on your tax return, we recommend consulting your CPA or tax advisor.

How do I access my 1099-MISC online?

Your 1099-MISC has been securely shared with you through your Owner Portal. To access it:

-

Log in to your Owner Portal using the link provided in your email notification or at the top of our website.

(If this is your first time logging in, follow the prompts to create your account.) -

Once logged in, go to the Documents section.

-

Open the document titled with "Online Access Wizard - 2025 1099" and follow the steps provided to access your secure 1099.

If you need additional help accessing your portal or documents, please email our General Manager at jessica.vancloyd@rentodp.com.

How do I access my annual statement packet?

-

Log in to your Owner Portal using the link provided in your email notification or at the top of our website.

(If this is your first time logging in, follow the prompts to create your account.) -

Once logged in, go to the Statements section.

-

Open the statement packet dated Jan 1, 2025 to Dec 31, 2025.

If you need additional help accessing your portal or documents, please email our General Manager at jessica.vancloyd@rentodp.com.

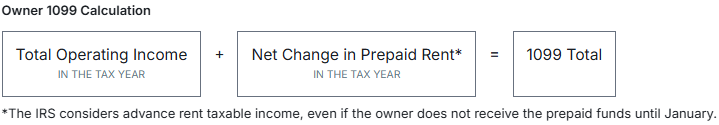

How is my 1099-MISC amount calculated?

Why doesn’t my 2025 reporting show January and February activity?

We transitioned to a new management and acounting software at the end of March 2025. During this process, all January through March activity was brought into the new system as a single balance forward entry in March so we could accurately reconcile each property and ensure beginning balances were correct at the time of conversion. As a result, January and February details do not appear as separate months in the new system, but are included in the March balance forward to preserve accurate totals for the year.

Why does my March 2025 balance forward for Jan–Mar only show two months of rent?

January 2025 rent was collected in December 2024 as prepaid rent. Under our prior system, prepaid rent was reported as prepaid rent income on your 2024 income statement, though it applied to January occupancy.

Under our new system, prepaid rent is held in a liability account on the balance sheet and is not recognized on the income statement until the month it applies. Going forward, January rent will appear only in January (not December) on your income statement, and will appear as a prepaid rent liability on the balance sheet.

Your March 2025 statement reflects only February and March rent because January was already reported last year. This change aligns with accrual accounting and GAAP and ensures rent is reported on the statement in the period it is actually earned. Your 1099-MISC, however, reflects the required net change in prepaid rent in accordance with IRS reporting rules.

For further information, please see Publication 527 regarding Advance Rent and Publication 538 regarding Constructive Receipt from the IRS.

Why do tenant reimbursements appear as "Other Income" on my income statement?

When a tenant reimburses for damage or owner-paid repairs, we show that amount as Other Income on your income statement rather than netting it out directly against the expense. This keeps the full repair cost visible and clearly identifies amounts charged back to the tenant, even when the timing or amount does not exactly match the original expense or relates to a prior-year repair. While reimbursements could be presented as a contra-expense, this approach provides clearer reporting and still results in the same bottom-line financial outcome. These reimbursements are not rent, do not affect operating performance or NOI, and are not 1099-reportable.

Note: Taxable income recognition and 1099 reporting follow different IRS rules, which is why reimbursements may appear on your income statement, but are not reported on a 1099.

Why don’t my 1099 totals, monthly income statement, and owner payments match each other?

Each report serves a different purpose: your 1099-MISC is for annual income reporting to the IRS, your Income Statement shows monthly financial performance, and your owner payment reflects available cash on a specific processing date.

Because they answer different questions, these numbers are not expected to match.

Your 1099-MISC reflects gross rent receipts collected in the calendar year. It does not subtract expenses, management fees, or repairs. This amount should be compared alongside your Cash Flow statement.

Your monthly income statement shows the net financial activity for the entire month, including rent earned, expenses incurred, reimbursements, and adjustments. This represents full calendar-month activity, not the amount paid out to you.

Your owner payment and accompanying monthly Owner Statement (Enhanced) report reflect the net cash available for disbursement at the time we process payments mid-month. There is usually additional activity between that payment date and the end of the month that appears on your income statement, but not in that owner payment.

Because of timing and purpose:

• 1099s show gross annual rent

• Income statements show monthly financial performance

• Owner payments reflect net available cash on a specific date

For a complete financial picture, owners rely on the Income Statement along with the Balance Sheet and Cash Flow, and the Owner Statement (Enhanced) report provides transaction-level detail between owner payments when needed.

Still have questions?

We are happy to help! Please contact our office at Office@RentODP.com for further assistance.

.webp?width=491&height=80&name=transparent%20logo%20new%20(1).webp)